Safeguard Your Child's Future: Learn to Save for College Carefully

Wiki Article

Achieving Financial Success in University: Practical Planning Tips for Pupils

As tuition prices continue to climb and living costs add up, it is critical for pupils to establish sensible preparation approaches to attain financial success during their college years. From setting financial goals to taking care of trainee lendings, there are numerous actions that students can take to guarantee they are on the right track towards a secure economic future.Setting Financial Goals

When establishing economic goals, it is important to be sensible and certain. As opposed to just aiming to conserve money, set a certain amount that you intend to save monthly or term. This will certainly provide you a clear target to function in the direction of and make it less complicated to track your progression. Furthermore, see to it your goals are possible and realistic within your present monetary scenario. Setting castle in the airs can result in aggravation and inhibit you from remaining to work in the direction of financial success.

Furthermore, it is essential to prioritize your economic goals. Establish what is most important to you and concentrate on those goals. Whether it is settling trainee car loans, conserving for future expenses, or constructing a reserve, comprehending your priorities will help you designate your sources successfully.

Creating a Spending Plan

When creating a spending plan, begin by determining your incomes. This might include cash from a part-time work, scholarships, or financial assistance. Next, listing all your costs, such as tuition costs, books, lease, utilities, transportation, and meals. When estimating your expenditures., it is vital to be complete and realistic.

When you have actually determined your earnings and expenditures, you can allot your funds accordingly. Think about alloting a section of your revenue for emergencies and financial savings. This will certainly help you develop a safeguard for unforeseen expenses and future goals.

Testimonial your spending plan consistently and make modifications as needed. This will certainly guarantee that your spending plan remains sensible and effective. Tracking your costs and comparing them to your budget will certainly aid you recognize locations where you can reduce or make improvements.

Creating a budget plan is a vital device for monetary success in university. It permits you to take control of your finances, make notified decisions, and work towards your financial objectives.

Making The Most Of Scholarships and Grants

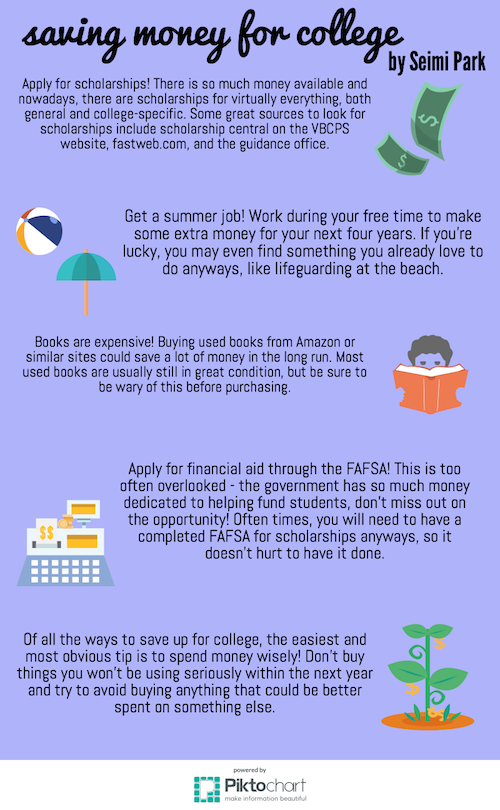

Taking full advantage of grants and scholarships can substantially relieve the economic worry of university costs. Scholarships and gives are forms of financial assistance that do not need to be paid off, making them an optimal method for trainees to money their education and learning. With the climbing expense of tuition and charges, it is critical for trainees to optimize their opportunities for grants and scholarships.One method to optimize scholarships and gives is to begin the search early. Lots of organizations and organizations provide scholarships and gives to trainees, however the application target dates can be months in development. By beginning early, students can use and research for as numerous opportunities as possible.

Additionally, pupils should thoroughly review the eligibility needs for every scholarship and give. Some might have details requirements, such as academic achievements, area involvement, or certain majors. By understanding the needs, trainees can customize their applications to highlight their toughness and enhance their opportunities of obtaining financing.

Furthermore, pupils need to think about getting both neighborhood and nationwide grants and scholarships. Neighborhood scholarships commonly have fewer candidates, boosting the he said possibility of obtaining an award. National scholarships, on the other hand, might use higher financial value. By expanding their applications, trainees can optimize their possibilities of securing economic aid (Save for College).

Taking Care Of Student Loans

One essential facet of navigating the monetary duties of college is successfully taking care of student financings. With the rising expense of tuition and living expenditures, numerous trainees rely upon car loans to money their education and learning. However, mismanaging these financings can lead to long-lasting economic worries. To avoid this, trainees must take numerous actions to properly manage their student car loans.First and primary, it is very important to comprehend the terms and problems of the financing. This consists of recognizing the rate of interest, payment period, and any prospective fees or fines. By recognizing these information, pupils can intend their funds appropriately and stay clear of any type of surprises in the future.

Producing a budget is an additional look at more info vital step in taking care of pupil finances. By tracking revenue and costs, trainees can guarantee that they allocate adequate funds in the direction of funding repayment. This also aids in identifying locations where costs can be reduced, permitting even more money to be routed towards lending settlement.

Furthermore, students need to check out alternatives for finance forgiveness or settlement support programs. These programs can provide alleviation for borrowers that are struggling to settle their car loans. It is important to research study and understand the qualification criteria and demands of these programs to make the most of them.

Last but not least, it is important to make prompt funding payments. Missing or postponing repayments can bring about additional charges, fines, and unfavorable influence on credit score scores. Setting up automated payments or pointers can aid ensure that repayments are made promptly.

Conserving and Investing Methods

Browsing the financial obligations of university, consisting of effectively managing trainee financings, sets the structure for pupils to execute saving and investing methods for lasting economic success.Saving and investing techniques are necessary for university student to secure their financial future. While it may seem intimidating to begin spending and conserving while still in university, it is never ever prematurely to start. By implementing these strategies at an early stage, trainees can benefit from the power of compound rate of interest and develop a solid financial foundation.

One of the primary steps in spending and conserving is developing a spending plan. This enables trainees to track their earnings and costs, identify areas where they can reduce, and allocate funds in the direction of financial savings and financial investments. It is essential to set specific financial objectives and produce a plan to achieve them.

An additional strategy is to develop a reserve. This fund acts as a safeguard for unexpected expenses or emergency situations, such as clinical important link costs or auto repairs. By having a reserve, pupils can stay clear of entering into financial debt and keep their monetary stability.

Verdict

Finally, by establishing financial goals, developing a budget plan, making the most of gives and scholarships, taking care of trainee lendings, and executing conserving and investing techniques, university student can achieve financial success during their university years - Save for College. Taking on these useful preparation tips will assist trainees create responsible financial practices and make sure an extra secure futureAs tuition costs continue to increase and living expenses add up, it is vital for pupils to create practical planning strategies to achieve monetary success during their college years. From setting economic objectives to taking care of pupil lendings, there are various steps that students can take to ensure they are on the right track towards a stable economic future.One crucial aspect of browsing the economic duties of university is successfully handling trainee fundings. To avoid this, students should take several steps to properly handle their student loans.

Saving and spending techniques are vital for university pupils to protect their monetary future.

Report this wiki page